Horizon's Tax and HR Alerts

HR and Tax Snapshots - Experts Answering Common Questions

-

Ohio's Pay Stub Protection Act Goes Into Effect on April 8th, 2025 | April 6, 2025

Under Ohio's Pay Stub Protection Act, effective April 8, 2025, employers must provide employees with written or electronic statements for each pay period, including the employee's name and address, employer's name, gross and net wages, additions/deductions, and pay period dates.

On January 8, 2025, Ohio Governor Mike DeWine signed the Pay Stub Protection Act, which takes effect on April 8, 2025. This act, which the Ohio House and Senate passed unanimously, requires all Ohio employers to provide pay statements to employees containing specific information about wages and hours worked.

When the Pay Stub Protection Act, or House Bill 106, goes into effect, employers will be required to include certain details within their employees’ pay statements.

-

FTC Announces Rule Banning Non-Competes | April 24, 2024

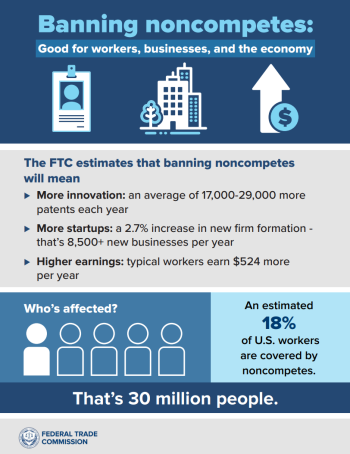

On April 23, 2024 the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives - who represent less than 0.75% of workers - can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

-

What the New Overtime Rule Means for Workers | April 23, 2024

One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. Simply put, every worker’s time has value. A cornerstone of that promise is the Fair Labor Standards Act’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S.

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.

Some workers are specifically exempt from the FLSA’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees. This exemption, typically referred to as the “EAP” exemption, applies when:

- An employee is paid a salary,

- The salary is not less than a minimum salary threshold amount, and

- The employee primarily performs executive, administrative or professional duties.

While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary threshold, lessening its effectiveness in helping to identify exempt EAP employees.

The department’s new overtime rule was developed based on almost 30 listening sessions across the country and the final rule was issued after reviewing over 33,000 written comments. We heard from a wide variety of members of the public who shared valuable insights to help us develop this Administration’s overtime rule, including from workers who told us: “I would love the opportunity to...be compensated for time worked beyond 40 hours, or alternately be given a raise,” and “I make around $40,000 a year and most week[s] work well over 40 hours (likely in the 45-50 range). This rule change would benefit me greatly and ensure that my time is paid for!” and “Please, I would love to be paid for the extra hours I work!”

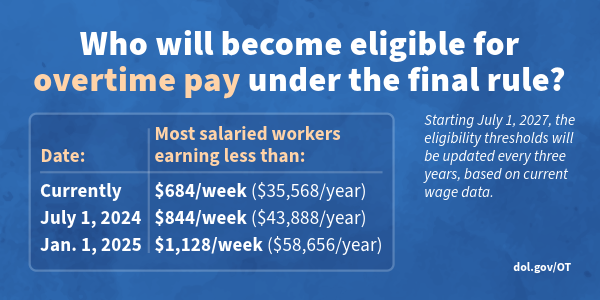

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA.

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees.

The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if certain requirements are met) from $107,432 per year to $132,964 per year on July 1, 2024, and then set it equal to $151,164 per year on Jan. 1, 2025.

Starting July 1, 2027, these earnings thresholds will be updated every three years so they keep pace with changes in worker salaries, ensuring that employers can adapt more easily because they’ll know when salary updates will happen and how they’ll be calculated.

The final rule will restore and extend the right to overtime pay to many salaried workers, including workers who historically were entitled to overtime pay under the FLSA because of their lower pay or the type of work they performed.

We urge workers and employers to visit the DOL website to learn more about the final rule.

This article was written by Jessica Looman, and originally published on https://blog.dol.gov/2024/04/23/what-the-new-overtime-rule-means-for-workers. Jessica is the administrator for the U.S. Department of Labor’s Wage and Hour Division. Follow the Wage and Hour Division on Twitter at @WHD_DOL and LinkedIn.

-

Illinois Paid Leave For All Workers Act | January 1, 2024

The Paid Leave for All Workers Act (PLAWA) allows workers to earn up to 40 hours of leave from work each year. Workers can use paid leave for any reason and employers may not require workers to provide a basis for their time off request. Workers earn one (1) hour of paid leave for every 40 hours they work. If an employer has an existing policy, certain exceptions may apply. There are certain categories of workers that are not subject to the law.

The Department of Labor is in the process of preparing guidance and other resources and materials to educate employees and assist employers with compliance.

Read the Law: 820 ILCS 192/Paid Leave for All Workers Act. (ilga.gov)

For more information please visit: https://labor.illinois.gov/laws-rules/paidleave.html or check out the Illinois Department of Labors Paid Leave FAQS

-

Minnesota's Earned Sick and Safe Time Act | January 1, 2024

Effective Jan. 1, 2024, Minnesota’s earned sick and safe time law requires employers to provide paid leave to employees who work in the state.

What is sick and safe time?

Sick and safe time is paid leave employers must provide to employees in Minnesota that can be used for certain reasons, including when an employee is sick, to care for a sick family member or to seek assistance if an employee or their family member has experienced domestic abuse, sexual assault or stalking.

Who is eligible for sick and safe time?

An employee is eligible for sick and safe time if they:

-

work at least 80 hours in a year for an employer in Minnesota; and

-

are not an independent contractor.

Temporary and part-time employees are eligible for sick and safe time. Sick and safe time requirements will not apply to building and construction industry employees who are represented by a building and construction trades labor organization if a valid waiver of these requirements is provided in a collective bargaining agreement.

How much sick and safe time can employees earn?

An employee earns one hour of sick and safe time for every 30 hours worked and can earn a maximum of 48 hours each year unless the employer agrees to a higher amount.

At what rate must sick and safe time be paid?

Sick and safe time must be paid at the same hourly rate an employee earns when they are working.

What can sick and safe time be used for?

Employees can use their earned sick and safe time for reasons such as:

-

the employee’s mental or physical illness, treatment or preventive care;

-

a family member’s mental or physical illness, treatment or preventive care;

-

absence due to domestic abuse, sexual assault or stalking of the employee or a family member;

-

closure of the employee’s workplace due to weather or public emergency or closure of a family member’s school or care facility due to weather or public emergency; and

-

when determined by a health authority or health care professional that the employee or a family member is at risk of infecting others with a communicable disease.

Which family members are included?

Employees may use earned sick and safe time for the following family members:

-

their child, including foster child, adult child, legal ward, child for whom the employee is legal guardian or child to whom the employee stands or stood in loco parentis (in place of a parent);

-

their spouse or registered domestic partner;

-

their sibling, stepsibling or foster sibling;

-

their biological, adoptive or foster parent, stepparent or a person who stood in loco parentis (in place of a parent) when the employee was a minor child;

-

their grandchild, foster grandchild or step-grandchild;

-

their grandparent or step-grandparent;

-

a child of a sibling of the employee;

-

a sibling of the parents of the employee;

-

a child-in-law or sibling-in-law;

-

any of the family members listed in 1 through 9 above of an employee’s spouse or registered domestic partner;

-

any other individual related by blood or whose close association with the employee is the equivalent of a family relationship; and

-

up to one individual annually designated by the employee.

What additional sick and safe time responsibilities do employers have?

In addition to providing their employees with one hour of paid leave for every 30 hours worked, up to at least 48 hours each year, employers are required to:

-

include the total number of earned sick and safe time hours available for use, as well as the total number of earned sick and safe time hours used, on earnings statements provided to employees at the end of each pay period;

-

provide employees with a notice by Jan. 1, 2024 — or at the start of employment, whichever is later — in English and in an employee’s primary language if that is not English, informing them about earned sick and safe time; and

-

include a sick and safe time notice in the employee handbook, if the employer has an employee handbook.

The Minnesota Department of Labor and Industry has created a uniform employee notice that employers can use. It is in English and translated into 17 additional languages; employers can request additional languages.

For more information please visit the Minnesota Department of Labor and Industry's ESST FAQ Page

-

-

Illinois retirement mandate deadline quickly approaching | September 24, 2023

The Illinois Secure Choice Savings Program Act aims to increase retirement savings access to private-sector employees. Companies with five or more employees are required to register by November 1, 2023. Approved by the state in July 2021, H.B. 0117 requires employers with at least five employees to:

- Automatically enroll each employee who has not opted out of participation in the program

- Provide payroll deduction arrangements and deposit fund into the program on behalf of those employees

- Create automatic, annual increases to contribution rates up to a maximum of 10% of a participant's wages

Who is required to provide a plan? Businesses that:

- Have at least 5 employees that work in Illinois

- Have been in business at least 2 years

- Do not offer a qualified savings plan such as a 401(k), SEP-IRA, or Simple IRA

Upcoming deadline:

- Illinois Employers with 5+ employees: November 1, 2023

Deadlines that have passed:

- Illinois Employers with 16-24 employees: November 2022

- Illinois Employers with 25-99: November 2019

- Illinois Employers with 100-499: July 2019

Illinois Secure Choice is legally mandatory. Employers who do not comply may be subject to penalties.

- $250 fine for each employee for the full or portion of the first calendar year in which the employee isn’t enrolled or didn’t opt out of the plan

- $500 fine for each employee for the full or portion of the second calendar year in which the employee isn’t enrolled or didn’t opt out of the plan

-

IRS orders immediate stop to new Employee Retention Credit processing | September 14, 2023

IRS announces moratorium on processing new claims for ERC (employee retention credit)

On September 14, 2023, the IRS announced (IR-2023-169) in a news release that it was immediately pausing processing of new claims for the employee retention credit (ERC) through at least the end of the year due to continuing concerns about improper claims.

The ERC is a refundable federal employment tax credit that was first enacted as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in 2020 and repeatedly modified and extended. The credit is available for qualified wages paid by eligible employers during the pandemic from March 13, 2020, through September 30, 2021.

The credit is generally claimed by filing a refund claim for the relevant quarter. While many refund claims already have been paid, others are still pending. The IRS has noted its concerns about the legitimacy of many of the refund claims, putting aggressive promotion of the ERC at the top of its "Dirty Dozen" list of tax scams for 2023.

The IRS has received approximately 3.6 million ERC claims since the program started. According to the IRS, the total inventory of unprocessed Forms 941-X, on which the ERC is claimed, was approximately 637,000 as of September 6, 2023.

-

Florida Employers Required to Use E-Verify (SB 1718) | July 1st, 2023

Florida’s SB 1718 went into effect on July 1st, 2023, requiring all public employers and all private employers with 25 or more employees to use e-Verify. This means that in Florida, e-Verify certification is required for all employees hired on or after July 1st, 2023.

What is e-Verify, you ask? It's an online system that helps confirm the eligibility of employees to work legally in the United States. Applicable employers must use e-Verify to certify the employment eligibility of all of their employees performing services within the state of Florida.

Penalty for Non-Compliance: The Florida Department of Commerce is required to issue a fine of $1,000 per day if it is determined that the E-Verify system was not used three times in a 24-month period. The fine will continue to accrue until the employer demonstrates compliance with the law.

If you have any questions or need compliance assistance in implementing this system, don't hesitate to reach out to our team! -

Illinois Paid Leave For All Workers Act Takes Effect January 1st, 2024 | May 12, 2023The Department of Labor is in the process of preparing guidance and other resources and materials to educate employees and assist employers with compliance. If you would like to submit a question or comment, you may do so by emailing: DOL.PaidLeave@illinois.gov

Read the Law: 820 ILCS 192/Paid Leave for All Workers Act. (ilga.gov)

In March 2023, SB208 was signed into law, making Illinois the third state in the nation, and the first in the Midwest, to mandate paid time off to be used for any reason. The legislation provides employees with up to 40 hours of paid leave during a 12-month period, meaning approximately 1.5 million workers will begin earning paid time off starting in 2024.

Under existing law, workers are not guaranteed pay when taking time off for sick leave, childcare, mental health reasons, medical appointments, vacation, or any other reason. Starting on March 31st, 2024, or 90 days following commencement of employment, workers can begin using their earned time off for any reason without the requirement of providing documentation to their employer under the Paid Leave for Workers Act.

This new law applies to every employee working for an employer in Illinois, including domestic workers, but does exclude independent contractors. The City of Chicago and Cook County have an existing paid sick leave ordinance in place; employees and employers in those two geographic regions will be subject to those ordinances. The law will also exempt employees covered by a collective bargaining agreement in the construction industry and parcel delivery industry.

The legislation provides that paid leave shall accrue at the rate of one hour for every 40 hours worked. Employees will be paid their full wage while on leave and tipped workers will be paid the minimum wage in their respective locale. An employer cannot require an employee to find their replacement for the leave.

FAQ about the Paid Leave For All Workers Act

The following FAQs were published by the Illinois Department of Labor on May 23, 2023:

The Frequently Asked Questions (FAQs) provided below highlight topics and specific questions that are often asked of the Illinois Department of Labor (IDOL). The information provided in the FAQs is intended to enhance public access and understanding of IDOL laws, regulations and compliance information.

The FAQs should not be considered a substitute for the appropriate official documents (i.e. statute and/or administrative rules.) Individuals are urged to consult legal counsel of their choice. Court decisions may affect the interpretation and constitutionality of statutes. The Department cannot offer individuals legal advice or offer advisory opinions. If you need a legal opinion, we suggest you consult your own legal counsel. These FAQs are not to be considered complete and do not relieve employers from complying with applicable IDOL laws and regulations.

1. Are schools required to comply with the Paid Leave for All Workers Act (the Act)?

Public school districts organized under the School Code are exempt from the Act. A private school, not organized under the school code, is not exempt from the Act. (See 820 ILCS 192/10.)2. Cook County has a paid leave ordinance, but municipalities are allowed to opt out of that county ordinance. Are employers located in municipalities which opted out required to comply with THE ACT?

Yes, employers located in jurisdictions that have opted out of a local paid leave law or ordinance are required to comply with the Illinois Paid Leave for All Workers Act.3. My employer already provides paid time off. Do they have to add another 40 hours of leave under the Act?

An employer who already offers paid leave benefits that meet the minimum requirements of the Act does not have to add additional time.4. Does the Act apply to part-time employees, or just full-time employees?

The Act doesn’t distinguish between part time, full time, or seasonal employees. Both full-time and part-time workers are covered by this Act.5. Can an employer front-load paid leave time at the beginning of the year?

Yes, an employer may front-load paid leave time by giving a full year’s worth of leave that meets the minimum requirements of the Act to an employee at the beginning of the year.6. Can an employer require employees to accrue paid leave time over the course of the year?

Yes, an employer may require their employees to accrue paid leave time based on number of hours worked, at a rate of one hour of paid leave for every 40 hours worked.

Notably, while a part-time worker might not accrue the full 40 hours of leave provided for in the law by the end of the year, they might accrue fewer hours of leave, based on the number hours they’ve worked.

Example: Employee A works 15 hours per week, 52 weeks per year. They will accrue 19.5 hours of paid leave annually. (15 times 52 = 780 hours worked per year. 780 divided by 40 = 19.5 hours of paid leave.)7. When does accrual begin under the Act? When can employees start taking paid time off?

The Act takes effect January 1, 2024. Accrual begins upon beginning employment or January 1, 2024, whichever is later. However, employees are entitled to begin using the accrued paid leave after 90 days.

The first day employees could take off time that has accrued since January 1, 2024 would be March 31, 2024.

Example: The Paid Leave for All Workers Act takes effect January 1, 2024. Six months later, Employee B starts a new job on July 1, 2024, and works 40 hours per week. They start accruing paid leave on their first day (July 1) but must wait 90 days (until September 29, 2024) before taking any of their accrued paid leave.

Example: Employee C has worked for their employer since 2019 but did not previously get paid time off. Employee C will begin accruing paid time off beginning January 1, 2024 (the effective date of the Act.)8. How does accrual apply to employees who work more than 40 hours in a week, but are exempt from the overtime requirements of the federal Fair Labor Standards Act?

Employees (including but not limited to those commonly known as “salaried employees”) who are exempt from the overtime requirements of the federal Fair Labor Standards Act (29 U.S.C. 213(a)(1)) shall be deemed to work 40 hours in each workweek for purposes of paid leave time accrual if they regularly work 40 or more hours in a workweek. If such employee’s regular workweek is less than 40 hours, their paid leave time accrues based on the number of hours in their regular workweek.For more information about how this new act will impact your business, contact Horizon Payroll today!

-

A candidate told us they have a disability. What do we need to do? | February 1, 2023

We recommend asking if they need an accommodation during the application process, but above all, ensure that having this information doesn’t influence your hiring decision. The Americans with Disabilities Act (ADA) requires employers to provide accommodations to applicants with disabilities if needed to be considered for a job unless the accommodation causes an undue hardship. If the applicant doesn’t need an accommodation, simply continue to focus on the candidate’s skills and abilities relative to the position you’re hiring for.

As you’re likely aware, employers are prohibited from asking about disabilities before offering an applicant the job. As a best practice, you should be asking all candidates—not just those who disclose a disability or appear to have a disability—whether they can perform the essential functions of the job with or without a reasonable accommodation. This can be as simple as adding a question to your job application.

It’s important to not make assumptions about a candidate's ability to perform their job based on their disability. If a candidate during the post-offer stage requests an accommodation to perform the essential functions of their job, then you would engage in the interactive process with them to determine what accommodations may be effective.

This Q&A does not constitute legal advice and does not address state or local law.

Answer Provided by Rachel, SHRM-SCP

Rachel has a B.A. in Psychology, she began her HR background in employee relations, staffing and payroll as an HR Generalist for a variety of industries. During her free time, Rachel is an avid kayaker and plans to visit every National Park during her lifetime.

If you have any further questions, give us a call (937-434-8244)

-

What is “at-will employment”? Does that mean I can fire an employee for any reason? | January 18, 2023

At-will employment means that the employer or employee can end the employment relationship for almost any reason (with or without cause) at any time (with or without notice).

It does not, however, allow you to terminate someone for an illegal reason, like their inclusion in a protected class or their exercise of a legal right.

Every state (except Montana) assumes the employment relationship is at-will unless there is a legal agreement in place that says otherwise. Assuming you want to maintain the at-will relationship with employees, we recommend including clear language about this in your employee handbook. But keep in mind that even with an at-will relationship, terminations carry risk. A terminated employee can always claim that they were terminated for an illegal reason, at which point you’ll want to be able to show otherwise. To reduce that risk and nip any potential claims in the bud, you should have and document a lawful, business-related reason for each termination.

You can find more information on employment termination and at-will employment on the platform. If you would like more information on drafting an employment contract, please contact an attorney.

This Q&A does not constitute legal advice and does not address state or local law.Answer Provided by Marisa, SPHR

Marisa has experience working in a wide variety of HR areas, including payroll, staffing, and training. Having supported HR functions in various industries, Marisa is able to apply her knowledge to each client's particular situation. Marisa earned her B.S. in Business Administration and Communications from the University of Oregon.

If you have any further questions, give us a call (937-434-8244)

-

Florida threatens to suspend licenses of businesses failing to provide proof of E-Verify compliance | January 16, 2023

Florida is threatening to suspend licenses for businesses failing to provide proof of E-Verify compliance, which ensures they are not employing illegal immigrants. It comes as part of its greater effort to protect Florida residents and their jobs as the nation faces a mass immigration crisis on the southern border.

The Department of Economic Opportunity sent letters to several businesses, flagging the various companies for “repeat non-responsiveness” to the Florida Department of Law Enforcement (FDLE).

“If you persist and fail to respond to the Department of Economic Opportunity (DEO), there will be significant consequences,” the letters reads, warning that the notice serves as the “final opportunity to respond before consequences are initiated.”

It adds that the DEP will “not grant any extensions” or excuses for nonresponses. The companies had one month from the date of the letter to provide an affidavit stating the company will comply with the law and terminate the employment of illegal aliens.

Failure to comply with the letter in the given time frame would result in a suspension of “all licenses” held by the company “specific to the business location where the unauthorized alien(s) performed work.” In cases where they do not have a license specific to the business location where the illegal alien worked, the licenses held by the company at its “primary place of business” will be suspended.

This information has been sourced from a variety of news articles and public statements from the Florida Governors' Office. As the enforcement and policies change around E-Verify compliance, we will continue to provide updates.

This alert does not constitute legal advice and does not address state or local law.If you have any further questions, give us a call (937-434-8244)

-

We have received a lot of time off requests around the holidays, more than we can approve. Can we approve some but deny others? | December 21, 2022

In general, yes. We recommend having a policy for time off that explains how employees can request time away from work and what criteria the company uses to approve or deny requests. For example, you might base approvals on the order in which requests came in, the seniority of those requesting time off, the needs of the business, or some combination of these. Whatever your policy, take care that it doesn’t adversely affect members of certain protected classes. If male employees, for example, had their time requests granted more often than female employees, you could be looking at a discrimination claim.

If the holidays are either busier than usual or a more popular time for time off requests, you might consider a rotating holiday schedule or a set up where employees can sign up for an extra day off either before or after the holiday.

It’s also a good idea to specify how employees will know if their request has been granted and ensure that your managers understand your time off approval process.

This Q&A does not constitute legal advice and does not address state or local law.Answer from Kim, SPHR, SHRM-SCP

Kim is a results-driven HR Professional with experience from diverse industries, including but not limited to, transportation, environmental services, staffing, pharmaceutical, market research, banking, retail, software development and education non-profit.

If you have any further questions, give us a call (937-434-8244)

Tax and HR Alerts for Your Business (2019-2020)

-

New Minimum Salary for Exempt Employees | December 24, 2019

Reminder—New Minimum Salary for Exempt Employees

Starting January 1, 2020, most employees who are classified as exempt under the executive, administrative, professional, and computer employee exemptions will need to be paid at least $684 per week or $35,568 per year. See our full report in the News Desk of the HR Support Center for more information.

Minimum Wage Increase for Federal Contractors

On January 1, 2020, the minimum wage for employees doing work on or in connection with federal contracts will increase to $10.80 per hour. The minimum wage for covered tipped employees will increase to $7.55 per hour.

New W-4

In the new year, employers will need to provide the redesigned Form W-4 to new employees and current employees who want to change their withholdings. Employees who have submitted Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers should continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

Two of the biggest changes to the form are the elimination of allowances, which have been replaced by dollar values to calculate withholding, and the addition of boxes to indicate if workers hold multiple jobs or are in two-earner households.

The new form is divided into five steps. Employees will provide information for the steps that apply to them (steps 2-4 may not).

Step 1: Enter personal information (including marital status).

Step 2: Account for multiple jobs. This step is completed if the employee holds more than one job at a time or is married filing jointly and their spouse also works. The correct amount of withholding depends on income earned from all jobs.

Steps 3 and 4: Claim dependents and other adjustments (specifically, other income that is not from jobs, deductions, and extra withholding). Steps 3 and 4 are completed on Form W-4 for only one job, and these steps are left blank for the other jobs. Withholding is most accurate if an employee completes Steps 3 through 4(b) on the Form W-4 for the highest paying job.

Step 5: Employee signature and date.

Publication 15-T (still in draft form) assists employers in determining the amount of federal income tax to withhold from their employees’ wages.

Read about the Form W-4, browse the FAQs, see the 2020 version, and read about Publication 15-T.

We recommend that employers do not provide tax advice to employees, but instead direct them to the IRS’ Tax Withholding Estimator or their tax professional for guidance on completing the W-4.

Reminder: If your state has its own W-4, continue to offer the most current version to employees for voluntary completion to ensure accurate state tax withholding. -

DOL Release Final Overtime Rule, Effective Jan. 1, 2020 | October 3, 2019

The Department of Labor has announced the new minimum salary for certain exempt white collar employees. The final rule is very close to the proposed rule we reported on in March. The new minimums will take effect January 1, 2020.

Exempt Executive, Administrative, Professional and Computer Employees (EAP)

Salaried exempt EAP employees must be paid at least $684 per week on a salary basis (an increase from the current minimum of $455 per week). This is the equivalent of $35,568 per year.

Up to 10% of this minimum may come from non-discretionary bonuses, incentive payments, and commissions (collectively, “incentive pay”), so long as these payments are received on at least an annual basis. If an employee does not earn enough incentive pay to meet the minimum by the end of the year, the employer has two options: pay the difference with a “catch-up” payment within one pay period after the end of the 52-week year or retroactively remove the exemption and pay the employee for any overtime worked during that same year.

Teachers, practicing lawyers, practicing doctors, and outside salespeople are exempt from these minimums under federal law, though may be subject to state minimums.

Exempt Highly Compensated Employees (HCE)

The HCE exemption is intended for employees who don’t quite qualify for the EAP exemptions due to their job duties, but who happen to be paid extremely well. This exemption is used much less commonly than the others and most exempt employees will fall under the EAP exemptions.

Employees classified as exempt under the HCE exemption must make at least $107,432 per year. Of that amount, at least $684 per week must be paid on a salary or fee basis, with no reduction for future incentive pay. The remainder of their income, however—nearly 67% if they make $107,432—may come from incentive pay. If the employee does not earn enough in incentive pay to meet the minimum by the end of the year, the employer has the same two options as with EAP employees. They can make a catch-up payment (in this case within one month) or retroactively remove the exemption and pay the employee for any overtime worked during the previous year.

State Law

California, New York, and soon Washington have laws in place that make the minimum salary for exempt employees higher than the new federal thresholds. Since employers must follow the law that is most beneficial to employees, the new federal minimums would not affect employers in these states.

What Now?

Employers will need to evaluate anyone who they currently classify as exempt from overtime and pay less than $684 per week or $35,568 per year. Once these employees are identified, employers will need to choose between giving them a raise to meet the new minimum to maintain the exemption or reclassifying them as a non-exempt and paying overtime.

We have created numerous resources to help employers navigate this decision-making process and implement changes—just search FLSA Changes in the HR Support Center. -

EEO-1 Reporting Requirements Finalized | May 17, 2019

The hotly contested issue of what exactly needs to be filed for EEO-1 reporting this year has been resolved—at least for now. Pay data for both 2017 and 2018 must be reported to the Equal Employment Opportunity Commission (EEOC) by September 30, 2019. The data that has been required in years past is still due by May 31, 2019. An appeal of the latest decision has been filed, so it's possible that there could be yet another change to the requirements, but employers should plan to comply with these deadlines, as described below.

Does my business even need to file the EEO-1 report?

If you have fewer than 100 employees and no federal contracts, you are not subject to EEO-1 reporting requirements. Only two categories of employers need to submit EEO-1 data:

Organizations with 100 or more employees (excluding public primary and secondary schools, institutions of higher education, tribes, and tax-exempt private membership organizations);

Federal contractors with 50 or more employees, that also are prime or first-tier subcontractors with a contract worth $50,000 or more; or are a depository for US government funds in any amount; or are an issuing and paying agent for US Savings Bonds and Savings Notes.What information do I need to report and by when?

The EEOC has divided the information it requires into two categories, referred to as components.

Component 1 data: This is the information that has always been required. It includes data about all employees by job category, race, ethnicity, and sex. Component 1 data for calendar year 2018 is due by May 31, 2019. The online survey application is open and available here. If you have never filed the EEO-1 report before and believe you need to, start here.

Component 2 data: This is the newly required information. It includes data about all employees, including W-2 wages, total hours worked, race, ethnicity, and sex. This year employers will need to report Component 2 data for calendar years 2017 and 2018. Component 2 data is due by September 30, 2019. The online filing portal is not yet open, but expected to be available mid-July.

For both types of data, the preferred method of reporting is through the EEO-1 Survey Application, which generates a table for employers to provide the required information. Employers do not need to worry about creating and formatting a complicated report.

Additional Information

The EEOC has provided answers to Frequently Asked Questions and also created an Instruction Booklet. -

DOL Produces New Overtime Rule | March 11, 2019

The Department of Labor has released a new proposed rule to increase the minimum salary that an employee must earn to be exempt from minimum wage and overtime under a white collar exemption.

The Rule

The proposed rule requires that salaried exempt executive, professional, administrative, and computer employees must be paid at least $679 per week on a salary basis, an increase from the current minimum of $455 per week. The rule allows for non-discretionary bonuses and incentive payments to account for up to 10% of the minimum, so long as they are paid out on at least an annual basis; currently commissions and bonuses cannot be counted toward the minimum.

The DOL also proposes that highly compensated employees must be paid at least $147,414 per year to qualify as exempt. Of that amount, at least $679 per week must be paid on a salary or fee basis.

The anticipated effective date of this rule is January 2020.

The Department of Labor intends to update these minimums every four years based on increases to the Consumer Price Index. These increases will not be automatic, but will likely be done through notice and comment rulemaking, just as they are doing with this proposed rule.

Duties Test

There are no proposed changes to the duties tests for the various white collar exemptions. Employers should be aware that paying someone a minimum salary does not necessarily mean they are properly classified as exempt. Each of the exemption types mentioned above has a corresponding duties test. If the duties test is not met by the employee, then they are non-exempt and entitled to minimum wage and overtime, regardless of the method or amount of pay. You can learn more in the HR Support Center by entering the word exempt into the search bar.

State Law

California and New York (and soon Washington) already have laws in place that make the minimum salary for exempt white collar employees higher than these proposed thresholds. As employers must follow the law that is more beneficial to employees, the new proposed federal minimums would not affect employers in these states.

Resources

Numerous resources to help employers navigate this change are available in the HR Support Center. Search FLSA Changes to find a Decision-Making Guide, Implementation Guide, information about the duties tests, and more. -

OSHA Electronic Reporting of Form 300A Data Due Date | February 25, 2019

All OSHA-covered employers (those not on this list) with 250 or more employees, and those in certain high-risk industries with 20-249 employees, must electronically report their Calendar Year 2018 Form 300A data by March 2, 2019. Reporting must be done through the online Injury Tracking Application (ITA).

-

Reminder: OSHA 300A Forms Must Be Posted by February 1 | January 28, 2019

The Occupational Safety and Health Administration (OSHA) mandates that all employers who are required to maintain the OSHA 300 Log of Work-Related Injuries and Illnesses post a summary of the previous year’s log between February 1st and April 30th each year, even if no incidents occurred in the preceding calendar year. The summary (OSHA Form 300A) must be certified by a company executive and posted in a conspicuous location where notices to employees are customarily posted.

All employers who had more than ten employees at any point during the last calendar year are covered by this requirement unless they qualify as part of an exempt low-risk industry. A full list of the industries that are exempt from OSHA routine recordkeeping requirements (including posting Form 300A) can be found in the Guides section of the HR Support Center by searching “partially exempt industries.” It’s called “OSHA Fact Sheet: Reporting and Recordkeeping Rule and Partially Exempt Industries List.”

The OSHA Log of Work-Related Injuries and Illnesses (Form 300), Summary (Form 300A) and Instructions can be found in the Forms section of the HR Support Center by searching for “OSHA Form 300." It’s called “OSHA Form 300, 300A, 301, and Instructions.”

Electronic submission requirements:

OSHA-covered employers with 250 or more employees, and those in certain high-risk industries with 20-249 employees, must electronically report their Calendar Year 2018 Form 300A data by March 2, 2019. Reporting must be done through the online Injury Tracking Application (ITA).

All affected employers must submit injury and illness data in the ITA online portal, even if the employer is covered by a State Plan that has not completed adoption of their own state rule.

Additional information, covered-employer criteria, FAQs, and the Injury Tracking Application can be found on OSHA’s site, here.

New Final Rule Regarding Electronic Submission of Form 300 and Form 301

Yesterday, OSHA published a Final Rule to amend its recordkeeping regulations to remove the requirement to electronically submit information from the OSHA Form 300 (Log of Work-Related Injuries and Illnesses) and OSHA Form 301 (Injury and Illness Incident Report) for establishments with 250 or more employees that are required to routinely keep injury and illness records. These requirements were never enforced, but are now officially off the books. These employers are still required to submit Form 300A information electronically, as described above. -

Court Ruling on ACA Has No Impact on Employers | January 2, 2019

Last Friday, a federal judge in Texas ruled that the entirety of the Affordable Care Act (ACA) was unconstitutional due to changes made to the tax code last year. He said, in short, that eliminating the individual tax penalty made the whole law unworkable.

The judge did not issue an injunction, so the law remains fully in effect for now. There are no impacts to current or 2019 coverage and no changes to enrollment through healthcare.gov or through state-run Marketplaces. This decision will be appealed, and a final determination on this issue could easily take a year. Lawmakers may attempt to make fixes in the meantime.

We will keep you informed of relevant court decisions or acts of Congress. -

OSHA Reporting Due July 1, Including from State Plan Employers | June 27, 2018

OSHA-covered employers with 250 or more employees, and those in certain high-risk industries with 20-249 employees, must electronically report their Calendar Year 2017 Form 300A data by July 1, 2018. Reporting must be done through the online Injury Tracking Application (ITA). Covered establishments with 250 or more employees are only required to provide their Form 300A data, not Form 300 or 301 information, as was suggested by previous rule making.

Also, contrary to previous guidance, OSHA announced in late April that all affected employers must submit injury and illness data in the ITA online portal, even if the employer is covered by a State Plan that has not completed adoption of their own state rule.

Additional information, FAQs, and the Injury Tracking Application can be found on OSHA’s site, here.

For more help navigating the reporting contact us today. -

FLSA Amended to Allow Tip Pooling if No Tip Credit is Taken | April 24, 2018

The rules around tip pooling have been mired in litigation since 2011, when regulations came into effect that forbid tip pooling between employees who customarily receive tips and those who do not. The recently passed federal budget bill has created clarity by amending the Fair Labor Standards Act (FLSA) and eliminating that rule for employers who do not take a tip credit. Since the rule has been eliminated entirely, court decisions interpreting it—such as Oregon Restaurant and Lodging Association, et al v. the U.S. Department of Labor—are irrelevant.

The amended portion of the FLSA, while allowing for tip pooling between front and back of house employees if no tip credit is taken, clearly states that tips cannot be shared with managers or supervisors. To determine if someone is a manager or supervisor for the purpose of the tip pooling statute, employers should apply the White Collar Executive duties test below. An employee is only disallowed from sharing in tips if all of the following are true:

Their primary duty is the management of an enterprise in which the person is employed or a customarily recognized department or subdivision.

They customarily and regularly direct the work of two or more full-time employees (or the equivalent, e.g., four 20-hour per week employees).

They have the authority to hire, fire, or promote other employees or effectively recommend similar actions.

Given the specificity of the test, a fair number of workers who operate in a supervisory capacity on an occasional basis, or while performing their own customer service tasks, will likely still be eligible to share in tips.

Employers who do take a tip credit are still prohibited from enforcing any tip pooling system that shares tips with employees who do not customarily receive tips.

Contact us if you have any more questions. -

9th Circuit Rules Salary History Not an Acceptable Reason for Pay Discrepancies | April 12, 2018

The 9th Circuit Court of Appeals ruled Monday that salary history is not an acceptable reason for pay differences under the Equal Pay Act (EPA), even when used in conjunction with other factors. The EPA first became law in 1963 and prohibits the payment of different wages to men and women who do work that requires equal skill, effort, and responsibility under similar working conditions.

The new reading of the law impacts employers in Alaska, Washington, Montana, Idaho, Oregon, California, Nevada, and Arizona, but since Circuit Courts often rely on one another’s rulings, it’s very possible that the impact of this decision will spread.

As written, the EPA allows for pay discrepancies for the following reasons:

A seniority system;

A merit system;

A system that measures earnings by quantity or quality of production; or

Any factor other than sex.

Employers, including the defendant in this case, have often used salary history to help determine a new employee’s starting salary, and assumed that this would count as “any factor other than sex.” The court did not claim that this is an unreasonable reading of the law. Rather, it said that such a reading is contrary to the point of the law, as an employee’s past salary is likely to be impacted by gender-based pay discrimination.

Saving Money is Not Part of the Catch-All Provision

The Court also established that "any factor other than sex" is limited to legitimate, job-related factors, such as experience, education, and ability. The catch-all provision does not include business-related reasons, such as an individual’s willingness to work for lower wages or the need to offer higher wages to candidates in a more employee-friendly market. Essentially, the opportunity for cost-savings is not an acceptable reason for a pay differential.

The Court, however, deliberately stopped short of saying whether individualized salary negotiations—which may involve some reliance on past salary—would provide a defense, but suggested a future court could rule on that issue.

Action Items

Audit Your Pay Scales

Between the spread of equal pay legislation at the state level, the narrowing of the catch-all in the EPA, and the increased visibility of the women’s equality movement, there is no better time to take a long hard look at how your employees are paid.

If you are in the 9th Circuit and among the many employers who have based employee wages to some extent on salary history, that practice should be stopped immediately, and different wages adjusted or accounted for. Also look for factors that contributed to pay differentials that were business-related rather than job-related.

Be aware that you cannot reduce someone’s pay as a remedy under the EPA.

Stop Asking About Salary History

We have advised against asking candidates about their salary history for some time, but the advice becomes more urgent now. Although it is still legal to ask this question in most states, having this information is very likely to impact the offer made to a new employee. Even if the answer has no impact on the offer, the mere asking of the question implies that the employer intended to do something with the information, thereby opening the door for a discrimination claim. California, Oregon, Delaware, and Massachusetts (as of July 1) have already banned salary history inquiries.

We have an employment application in the HR Support Center that does not include any inquiries about past wages. It is available in both English and Spanish. You can find it by using the search bar and typing in Employment Application.

We are a Trusted Partner for Payroll & HR Support

Horizon Payroll is a professional partner for small-to-medium-sized businesses. We provide an array of business solutions, including payroll management, HR support, benefits management, attendance tracking, and more. Contact us today!

Tax and HR Alerts for Your Business (2017-2018)

-

Reminder: EEO-1 is Due by March 31 | March 23, 2018

The Equal Employment Opportunity Commission (EEOC) requires certain employers to submit a report categorizing their employees by race or ethnicity, gender, and job category. This demographic survey, called the EEO-1, is due by March 31. All employers with 100 or more employees must file the report.

Employers also must file if the organization is any of the following:

Owned by or affiliated with another company and the entire enterprise has 100 or more employees

A federal government prime contractor or first-tier subcontractor with 50 or more employees and with a contract or subcontract amounting to $50,000 or more:

- Serving as a depository of government funds in any amount

- A financial institution that is an issuing and paying agent for US Savings Bonds and Notes

If required to file, employers should follow these guidelines:

- Use employment data from one pay period in October, November, or December of 2017.

- For a single-establishment company, submit only one EEO-1 data report. For a multi-establishment company, submit a separate report for each location.

- Identify the race or ethnicity of employees based on how they identify themselves. If they decline to self-identify, then use employment records or visual observation.

- Include both full-time and part-time employees.

Include employees who telecommute in the survey for the location to which they report.

The EEOC would prefer that employers file online. When doing so, don’t forget to click the “certify report” button; otherwise, the EEOC will not receive your report. Go here to file, and find the EEOC’s FAQs on filing here. Questions? Contact us anytime. -

Second Circuit Rules Sexual Orientation is Protected by Title VII | February 28, 2018

Yesterday the Second Circuit Court of Appeals became the second federal appellate court to rule that under Title VII of the Civil Rights Act of 1964, the word sex includes sexual orientation. The first was the Seventh Circuit, which we reported on last April.

The Second Circuit Court’s ruling yesterday affects only New York, Vermont, and Connecticut. All three of these states already prohibit discrimination in employment because of sexual orientation, so the ruling does not have a significant impact on employers there. It does, however, ensure that it is possible for employees who feel they have been discriminated against based on sexual orientation to sue under both state and federal law.

Between 1979 and 2012, most of the circuit courts of appeal ruled that the term sex in Title VII did not include sexual orientation, including the Second Circuit in 2005. But in Monday’s decision, the court acknowledged that legal doctrine evolves. The court reasoned that although Congress may not have contemplated that discrimination “because of sex” would include sexual orientation when it drafted Title VII, that fact need not limit the court’s current interpretation of the statute. The court also pointed to the Equal Employment Opportunity Commission’s position (held since 2015) that sex includes sexual orientation as support for its ruling.

Although circuit courts of appeal often try to align their rulings with the decisions of the other circuits, and most circuits still do not currently recognize sexual orientation as part of sex, the two most recent decisions may indicate a shift in perspective and encourage other circuits to follow suit, overruling their past decisions in favor of a broader meaning for the word sex. The circuits’ conflicting decisions also make it more likely that the Supreme Court will accept a case on this issue soon. Watch for more info. -

Reminder: OSHA 300A Forms Must Be Posted by February 1 (2018) | January 22, 2018

The Occupational Safety and Health Administration (OSHA) mandates that all employers with more than 10 employees - except those in exempt low-risk industries - maintain a record of work-related injuries and illnesses. Those who are required to maintain these records should use OSHA’s Form 300: Log of Work-Related Injuries and Illnesses or an equivalent state-specific form, and forms must be posted by February 1.

Those same employers must then post OSHA’s Form 300A: Summary of Work-Related Injuries and Illnesses each year between February 1 and April 30. As its name implies, Form 300A summarizes (and sanitizes) the information logged on Form 300.

OSHA Form 300A must be certified by a company executive and posted in a conspicuous location where notices to employees are customarily posted. The notice must be posted even if there were no workplace-related injuries or illnesses.

In addition to these internal record keeping requirements, certain employers with 20 or more employees must submit their OSHA 300A form online by July 1. The website for submission is OSHA’s Injury Tracking Application (ITA), which can be found here. For more information or help navigating the forms, contact us today. -

DOL Adopts New Unpaid Intern Test | January 10, 2018

Last Friday, the Department of Labor (DOL) adopted a new test for unpaid interns. Employers should use this test—called the primary beneficiary test—when determining if a worker can be properly classified as an unpaid intern or if they need to be classified as an employee and paid minimum wage and overtime. The test adopted by the DOL has already been in use in four federal appellate courts, most recently the Ninth Circuit Court of Appeals. The DOL’s switch to the primary beneficiary test creates a nationwide standard.

Balancing v. All-or-Nothing

Previously, the DOL was using a six-question all-or-nothing test. An employer needed to be able to say “yes, the internship does that” to all six questions or else classify the worker as an employee. The new test is a balancing (or factors) test and has seven questions. No single question will disqualify the worker from being classified as an unpaid intern. Instead, the employer may look at the answers as a whole.

The New Questions

The new questions overlap significantly with the old questions. The major element missing from the new test is a focus on whether the intern is providing tangible benefit to the employer. The old test indicated that the employer should receive little to no benefit from the services of an unpaid intern, with the exception of goodwill and a qualified future applicant. The new test doesn’t ask if the employer is receiving a benefit.

In place of questions about whether the employer receives any benefits, the new test places more emphasis on the internship being academically focused. Only one of six questions in the old test asked about the training and educational aspects of the job, whereas four of seven do in the new test. Employers are free to look at factors outside of these seven, but should be careful about stretching to find new questions if these seven lead to an answer of “paid employee.”

Under the primary beneficiary test, employers should consider the following:

The extent to which the intern and the employer clearly understand that there is no expectation of compensation. Any promise of compensation, express or implied, suggests that the intern is an employee.

The extent to which the internship provides training that would be similar to that which would be given in an educational environment, including the clinical and other hands-on training provided by educational institutions.

The extent to which the internship is tied to the intern’s formal education program by integrated coursework or the receipt of academic credit.

The extent to which the internship accommodates the intern’s academic commitments by corresponding to the academic calendar.

The extent to which the internship’s duration is limited to the period in which the internship provides the intern with beneficial learning.

The extent to which the intern’s work complements, rather than displaces, the work of paid employees while providing significant educational benefits to the intern.

The extent to which the intern and the employer understand that the internship is conducted without entitlement to a paid job at the conclusion of the internship.

Questions? Contact Horizon anytime. -

Federal Contractor Minimum Wage Increase | December 15, 2017

The minimum wage for federal contractors will increase to $10.35 per hour as of January 1, 2018. The wage requirement applies to new and replacement contracts (solicited on or after January 1, 2015) with employers covered by the Service Contract Act or any employer who handles concessions and services in connection with federal property or lands. We recommend that employers review the pay rates of their employees and plan any changes necessary to comply with the rate increase. Questions? Drop us a line.

-

2018 State Minimum Wage Rates | December 13, 2017

For your convenience, we've posted the 2018 minimum wage rates. States seeing big increases include California, Maine, Maryland, and New York. Rates vary in many states according to factors like job location (e.g., city vs. state), business size, and benefits status. Questions? Contact us anytime.

-

Reminder: Employers Must Begin Using the New I-9 Form on Sept. 18th | September 17, 2017

Beginning Monday, September 18, employers must use the revised Form I-9 for all new employees. This new version of the form has the revision date of 7/17/17.

Access the new I-9 form here.

For help, contact us anytime. -

Overtime Rules Doubling Minimum Salary for White Collar Workers Officially Dead | August 29, 2017On August 29th, Judge Mazzant in the Eastern District of Texas issued his ruling on the Department of Labor’s overtime rule changes. The rules, which were slated to go into effect on December 1, 2016, have been on hold since he issued an injunction last November. As anticipated, the Judge ruled in favor of the Plaintiffs, finding that the DOL had overstepped its authority by making the new minimum salary so high.The DOL will not be appealing the decision, but labor or employees’ rights groups could theoretically take their place in the lawsuit. However, the DOL has said they would not enforce the 2016 rules, so any further action toward implementation will ultimately be ineffective.The DOL has, however, put out a Request For Information (RFI), seeking public comment that will presumably help it formulate an all-new set of rule changes.Confused? Contact us anytime.

-

New I-9 Form Will Be Released on July 19th | July 14, 2017Update: Access the new I-9 form here.The United States Citizenship and Immigration Services (USCIS) will release a new Form I-9, Employment Eligibility Verification, on Monday, July 17. The new Form I-9 will be available on the HR Support Center shortly after it is released.Employers will be able to use this revised version immediately, but may continue using the Form I-9 with a revision date of 11/14/16 through September 17, 2017. Beginning September 18, employers must use the revised form with a revision date of 07/17/17 for all new employees.The revisions to the Form I-9 are minor and employers will not need to change their processes.Revisions to the Form I-9 Instructions:The name of the Office of Special Counsel for Immigration-Related Unfair Employment Practices has been changed to its new name, Immigrant and Employee Rights Section.The words “the end of” have been removed from the phrase “the first day of employment.”Revisions related to the List of Acceptable Documents on Form I-9:The Consular Report of Birth Abroad (Form FS-240) has been added to List C.All the certifications of report of birth issued by the Department of State (Form FS-545, Form DS-1350, and Form FS-240) have been combined into selection C#2 in List C.All List C documents except the Social Security card have been renumbered.We'll be posting the form when it's available. For help now, contact us anytime.

-

Federal Appeals Court Rules in Favor of Employee Terminated for Obscene Facebook Posts about his Employer | June 14, 2017

A federal Appeals Court once again ruled in favor of an employee who fired off a string of obscenities aimed at his employer on Facebook. The Court found that the employee’s termination was wrongful because his rant constituted “concerted activity” under the National Labor Relations Act. This has been a murky and changing area of law, but the Court’s latest decision sheds some light on it.

It has always been the case that griping about low pay, bad hours, or mean managers in the physical presence of a co-worker would qualify as "concerted activity" and be protected by the NLRA. (Reminder: the NLRA protects employees in both unionized and non-unionized environments.) However, the extent to which these protections apply to online or social media has been a moving legal target.

Because of the ambiguity, and the overall employee-friendliness of the NLRB over the last several years, we have been advising clients to be extremely careful about disciplining employees for anything work-related they say on social media.

For more information on the NLRA, NLRB, or social media, contact us anytime. -

House Passes Comp Time Bill | May 11, 2017On Tuesday, the House passed the Working Families Flexibility Act. The Act would amend the Fair Labor Standards Act to allow employees who work more than 40 hours in a workweek to choose between overtime pay in the applicable pay period, as the law requires now, or time off in the future. That time off in the future (comp time) would be banked at the rate of 1.5 hours for each overtime hour worked. For example, an employee who works 44 hours in a workweek could choose between 4 hours of pay at 1.5x their regular rate, or 6 hours of paid time off in their comp time bank.If it becomes law, it will only apply to states that do not currently have their own overtime laws requiring premium pay for hours over 40 in a workweek.In states where comp time becomes legal – if it becomes legal at all – it may be used only if the employee chooses comp time instead of overtime pay. Employers will not be able to make comp time a standard practice or in any way coerce employees to choose comp time instead of overtime wages. Additionally, employees will have the option of asking for payout of their unused comp time at any time with 30 days' notice, and unused comp time will have to be paid out at the end of each year. Other limits and worker protections are included as well. Employers will not be required to offer a comp time option.This bill still needs to pass in the Senate – where it faces an uphill battle – and be signed by the President before it becomes a law.

-

House Passes New Healthcare Bill | May 4, 2017Yesterday the House narrowly passed a revised version the American Health Care Act (AHCA) – the GOP’s bill to repeal and replace the Affordable Care Act. The Senate has the next move. Rather than vote on the House bill, the Senate Republicans plan to write their own version and incorporate elements of the House bill into it.At present, there are no action items for employers. In its current form, the AHCA keeps the employer mandate requiring employers with 50 or more full-time equivalent employees to offer minimum essential coverage. However, it reduces the employer penalties to zero. So, employer reporting requirements would remain in effect, but there would be no financial penalties for failure to offer minimal essential coverage.If the AHCA becomes law, dropping coverage could still be financially risky according to some experts. Employers who simply drop coverage once the law goes into effect could, under some limited circumstances, potentially face lawsuits for impermissible reduction in benefits under the Employee Retirement Income Security Act (ERISA).Much remains unknown at this time. The Congressional Budget Office has yet to assess the House bill, and the Senate version of the bill could turn out to be very different, in which case the differences would need to be resolved in a conference committee.Confused? Contact us anytime.

Are you ready to stop pushing

paper and push your business?

We want to hear from you. We will assess your business needs and provide recommended solutions that fit. No pushy upsells. Just what we believe will get the most ROI.

Additional Tax and HR Alerts (2015-2016)

-

State Minimum Wage Increases for 2017 | December 13, 2016

-

2017 Standard Mileage Rates Announced | December 13, 2016

-

Good News About the FUTA Credit Reduction for Employers in Ohio and Connecticut | November 30, 2016

-

Federal Overtime Rules on Hold | November 23, 2016

-

IRS Extends Due Date to Distribute Forms 1095-C / 1095-B | November 23, 2016

-

New Form I-9 Released | November 15, 2016

-

Overtime Rules Go Into Effect on December 1, 2016 | November 14, 2016

-

Pay Data Will Now Be Required on EEO-1 Reports for Employers with 100 or More Employees | October 18, 2016

-

Revised Form I-9 To Be Published | October 3, 2016

-

EEO-1 Report Due September 30 | September 7, 2016

-

Department of Labor Penalty Increases | August 1, 2016

-

Work Opportunity Tax Credit Lookback Period Extended | June 17, 2016

-

Final FLSA White Collar Exemption Rules Announced | May 18, 2016

-

FLSA Exemption Changes | May 2, 2016

-

Minimum Wage Updates | May 1, 2016

-

Ninth Circuit Rules on Tip Pooling: No Mandated Sharing With Back-of-House | March 16, 2016

-

IRS Announces Extension on 1095 Form Filing | March 3, 2016

-

Post OSCA 300A Forms Now | February 1, 2016

-

New Jersey Bans the Box | March 1, 2015

-

Massachusetts Minimum Wage Increase | December 23, 2014

-

California Employers Now Allowed to Impose 90 Day Waiting Period for Health Care Coverage | December 1, 2014

-

New Social Media Privacy Protections in New Hampshire | October 15, 2014

-

California Expands Paid Family Leave Definition of Family | July 1, 2014

-

Closely-Held Companies Permitted to Decline to Provide Birth Control Coverage | June 30, 2014

-

IRS Reiterates Prohibition of and Penalty for Pre-Tax Employer Reimbursement for Health Premiums | June 30, 2014

HR Support

HR Support Time & Attendance

Time & Attendance Hiring & Onboarding

Hiring & Onboarding