8 min read

Horizon Stands Out in a World of Payroll Giants Like Paycor/Paychex

When it comes to payroll management, businesses are often faced with a tough decision: go with a big-name billion-dollar company like Paycor/Paychex...

Expert payroll management services with a personal touch.

View Solution Read Guide HR Support

HR SupportSimplify and personalize HR with a team of HR experts on-demand.

View Solution Read Guide Time & Attendance

Time & AttendanceWhy spend more unnecessary time and money managing your workforce?

View Solution Read Guide Hiring & Onboarding

Hiring & OnboardingTurn your candidates into employees with hiring & onboarding solutions.

View Solution Read GuideAdd On Solutions automate everyday tasks, prevent mistakes, and simplify business compliance.

View SolutionHelpful downloads and eBooks to empower your business.

Helpful tax and HR alerts to help keep your business compliant.

Payroll and tax-related forms and documents.

Horizon's blog provides valuable insight into payroll, compliance, human resources, and more.

See our client success stories for a case study on how we can help your business.

Payroll and HR strategy requires intelligent technology, personal attention and specialized expertise in the needs and nuances of your business.

We provide payroll and tax processing services for businesses from 1 to 1,000 employees or more. Today, we have nearly 1,000 customers in 40 states.

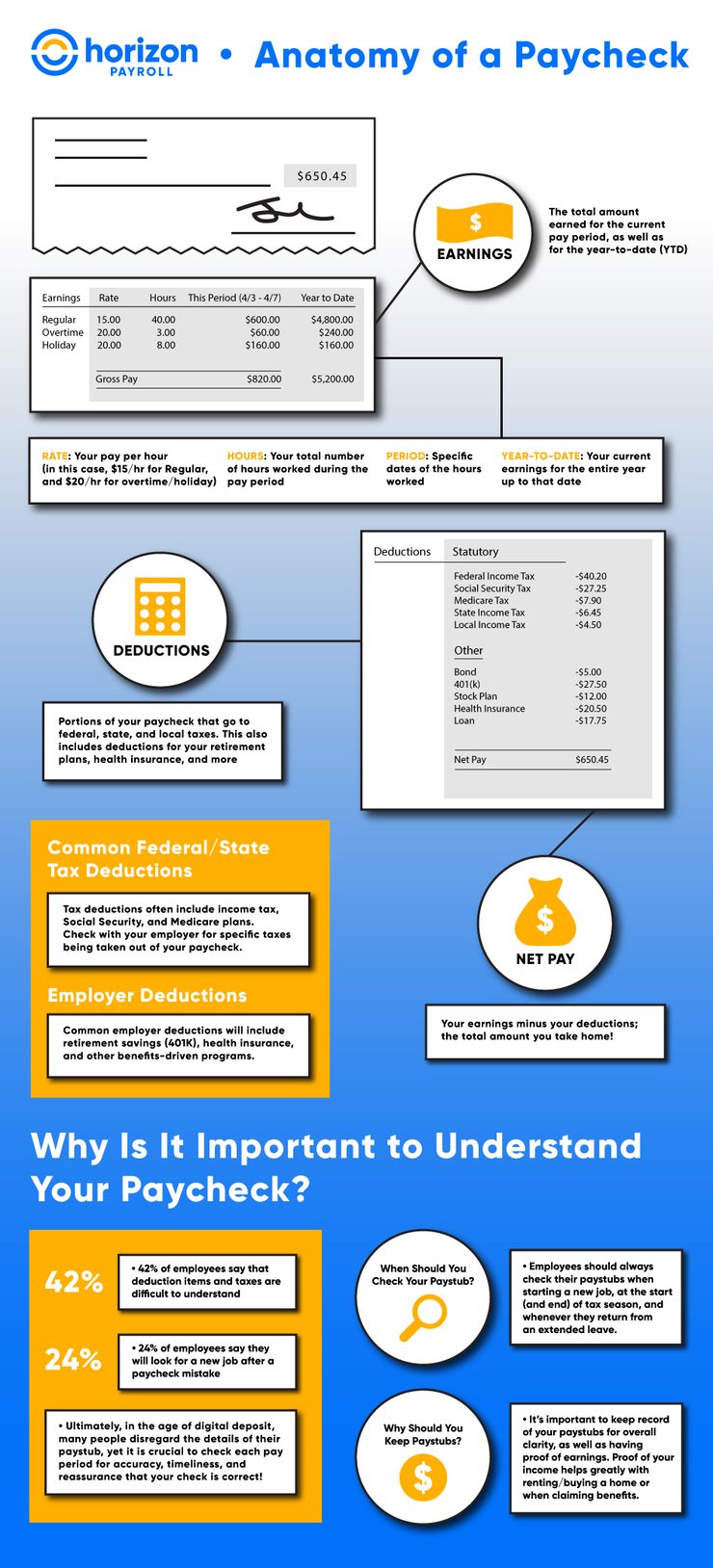

Understanding the different components of a paycheck can be intimidating and confusing. However, knowing what information is included in each pay stub and how that affects your overall financial picture is essential. This guide will provide an overview of the anatomy of a paycheck, break down the various sections and terminology found on a standard paycheck stub, and explain how the information contributes to your overall financial well-being.

Reading a paycheck can be tricky, especially in the age of direct deposit, but understanding how it works is vital for managing your finances. Below is a breakdown of the various components of a typical paycheck.

A pay stub is a summary of the wages you have earned in a specific payroll period. It is issued to employees by employers and serves as an essential record of income received, as well as any deductions that were taken out of the overall total.

Gross Pay is the total amount of money an employee earns before any deductions are taken. This includes salary, wages, bonuses, tips, and commissions. It is important to note that gross pay does not include taxes or other payroll deductions such as health insurance premiums or retirement contributions.

Net pay is the total amount of money an employee earns after all deductions have been taken out. This includes taxes and other payroll deductions, such as health insurance premiums or retirement contributions. Net pay represents the actual amount of money that will be deposited in an employee's bank account, sometimes referred to as “take-home pay”.

Standard mandatory deductions include state and federal taxes, Social Security, Medicare, and applicable local taxes. Other deductions may include child support payments and garnishments.

Standard benefit deductions include health insurance premiums, 401(k) contributions, life insurance premiums, disability insurance premiums, flexible spending accounts (FSAs), and commuter benefits.

Understanding how your paycheck breaks down can help you make better financial decisions and plan for the future. Knowing what deductions are taken out of each pay stub will give you a better idea of how much money you have available to spend or save after taxes, insurance premiums, retirement contributions, etc., are taken out. Ultimately, understanding the anatomy of a paycheck can help you better manage your money and plan for the future.

Check out our infographic above for more details!

Understanding the deductions of each paycheck can help you plan for your future financial goals. It's essential to familiarize yourself with the various deductions taken out of each pay stub and how they affect your overall financial picture each pay cycle.

Most paychecks include deductions for taxes, health insurance premiums, retirement contributions, and other benefits. Depending on your employer, you may also have deductions for childcare expenses or student loan payments. It's essential to be aware of the different types of deductions taken out of each paycheck so that you can plan and budget accordingly.

Federal income tax is when you pay money to the federal government, while state and local income tax is when you pay money to the state and your city or town, respectively. Taxes are typically taken out of your paycheck throughout the year and reduce how much money you get to take home.

Social Security taxes are money you pay towards your Social Security retirement benefits from the federal government; how much you pay for social security taxes depends on your overall earnings as an employee.

Benefit Deductions (Health Insurance, Retirement)

Health insurance deductions are taken out of an employee's paycheck to cover the cost of their health insurance premiums. Depending on the type of coverage, this could include medical, vision, and dental insurance premiums. These payments are usually taken out before taxes, reducing the money you will get at the end of the pay period.

Retirement contributions are taken from employees' paychecks to fund retirement savings plans. Depending on your employer and the type of retirement plan you have, these contributions may be matched up to a certain amount by your employer.

Health Savings Accounts (HSAs) are special accounts that can help pay for unexpected medical costs. You can put money into them from your paycheck, and the government will typically give you a tax break when you file in April.

Ensuring accuracy is critical when it comes to deductions from a paycheck. Understanding the different types of deductions and how they are taken out can help you ensure that the proper amounts are deducted from each pay stub. You should also review your pay stubs regularly for errors or overpayments to know you're getting what you are owed from each paycheck.

By understanding the anatomy of your paycheck, you can establish a budget that works for you and ensure you have enough money to pay your bills and save for the future. Knowing what deductions are taken from each paycheck can help you plan and ensure your finances are in order as well.

At Horizon, we work with small to medium-sized businesses to ensure the accuracy of their payroll and help with their tax compliance needs. Check out our full list of solutions and contact us today for a consultation!

Horizon has been a trusted partner for businesses since 1997. Our team offers top-rated business solutions and award-winning customer service to ensure your payroll, HR, and tax compliance needs are handled correctly and efficiently!

Our team is glad to offer top-rated payroll and HR solutions, as well as trusted customer service to address any issues or concerns you may have. If you want more information about our services, don't hesitate to get in touch with us today. We look forward to working with you!

8 min read

When it comes to payroll management, businesses are often faced with a tough decision: go with a big-name billion-dollar company like Paycor/Paychex...

7 min read

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA), commonly known as the Big Beautiful Bill, was signed into law by President Trump. It is a...

2 min read

We at Horizon want to thank you for being a part of our business family. We enjoy our partnership, and look forward to supporting you and your...