4 min read

Can You Afford to Misclassify Your Workers?

It’s Monday morning: Employees make their way to their workstations, the Keurig whirrs in the break room and the office starts to hum along as...

Expert payroll management services with a personal touch.

View Solution Read Guide HR Support

HR SupportSimplify and personalize HR with a team of HR experts on-demand.

View Solution Read Guide Time & Attendance

Time & AttendanceWhy spend more unnecessary time and money managing your workforce?

View Solution Read Guide Hiring & Onboarding

Hiring & OnboardingTurn your candidates into employees with hiring & onboarding solutions.

View Solution Read GuideAdd On Solutions automate everyday tasks, prevent mistakes, and simplify business compliance.

View SolutionHelpful downloads and eBooks to empower your business.

Helpful tax and HR alerts to help keep your business compliant.

Payroll and tax-related forms and documents.

Horizon's blog provides valuable insight into payroll, compliance, human resources, and more.

See our client success stories for a case study on how we can help your business.

Payroll and HR strategy requires intelligent technology, personal attention and specialized expertise in the needs and nuances of your business.

We provide payroll and tax processing services for businesses from 1 to 1,000 employees or more. Today, we have nearly 1,000 customers in 40 states.

3 min read

![]() Brad Johnson

:

January 22, 2020 at 4:45 PM

Brad Johnson

:

January 22, 2020 at 4:45 PM

By now, you’ve probably heard the IRS has released a redesigned version of form W-4 for 2020, also known as the Employee’s Withholding Certificate. Most employees will need to fill out a new W-4 now and then, but how does this new form factor into the mix?

The W-4 has changed, but the challenge for employees hasn’t: you need to know enough about your tax situation to fill out our W-4 to plan for your anticipated tax bill. Here’s what you need to know heading into 2020.

How you choose to set up tax withholding from each paycheck has a significant impact on how much you’ll owe on annual taxes (or how much of a refund you’ll receive). IRS advises everyone to review their W-4 regularly and make changes if necessary. Life changes like marriage, the birth of a child, adoption, or purchase of a home are good reasons to review your withholdings, but you can make changes at any time during the year and for any reason.

So, do you have to fill out the new form this year? No. Even though there is a redesigned form for 2020, the IRS notes that existing employees are not required to complete a new W-4. If you choose not to, “employers will continue to compute withholding based on the information from the employee's most recently furnished Form W-4.”

All new hires who are paid for the first time after 2019 will need to use the new form. According to the American Payroll Association (APA),” If a newly hired employee in 2020 does not complete a 2020 Form W-4, the employer instructions state that employers should treat them as a single filer with no other adjustments.”

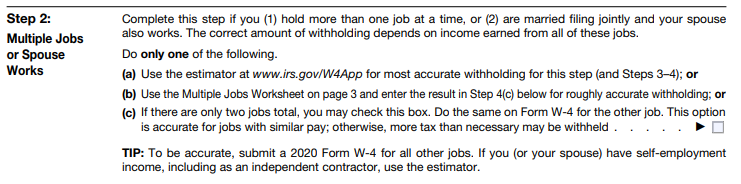

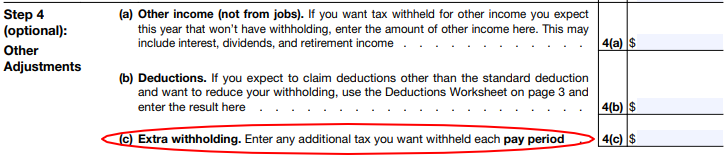

One change to the form appears in Step 2, if you have a working spouse and/or if you who hold more than one job. As before, the goal of this change is to withhold a total amount that comes as close as possible to the amount of taxes you owe. The IRS notes that “if you have more than one job at a time or are married filing jointly and both you and your spouse work, more money should usually be withheld from the combined pay for all the jobs than would be withheld if each job was considered by itself.” If desired, you “can adjust their withholding in Step 4(c) without sharing additional information.” See the IRS’s FAQ page for details.

Another change is that instead of setting up “allowances” to calculate the dollar amount withheld from each paycheck, you must now provide that dollar amount yourself. Because withholdings pay the majority of your annual tax bill, the idea is to set aside a small amount of each paycheck toward your taxes rather than paying one large bill all at once at filing time.

Knowing how much money to have withheld generally requires estimating the amount of taxes you’ll owe (which means estimating annual income and any anticipated deductions and tax credits). It’s vital for HR professionals to an eye on the boundary between assisting employees and providing tax advice, especially if employees are unfamiliar with how taxes work, such as someone starting their very first job.

If you have questions about calculating your taxes, it’s always a good idea to consult your tax preparer or to visit the tax withholding estimator tool on the IRS website. Your most recent pay stub shows how much is withheld each pay period and how much you’ve paid in so far this year. The critical question is this: are there enough pay periods remaining in the year to make up the difference between what’s been withheld and the estimated tax bill?

If there is not currently enough money being withheld to cover taxes, that amount is easily changed by completing another W-4 at any time. True, withholding more money results in a smaller paycheck, because more of it is going toward your anticipated tax bill. On the other hand, updating your W-4 early in the tax year means there are more pay periods available to put money toward that bill, spreading it out over a longer time period. Of course, there is no guarantee you won’t owe taxes at the end of the year (or that you’ll qualify for a refund).

From taxes to wages, benefits to office culture, there’s always something new in the HR world. How are you keeping up? Check our website for more insightful resources on the latest changes and topics that matter most in human resources, or contact us today.

4 min read

It’s Monday morning: Employees make their way to their workstations, the Keurig whirrs in the break room and the office starts to hum along as...

5 min read

2018 is coming fast! Are you paying attention to the changes and deadlines that are right around the corner? Our tips will help you navigate...

6 min read

Welcoming a new employee comes with the necessary hurdle of onboarding paperwork. The I-9 form is often the launching point for documenting the...