4 min read

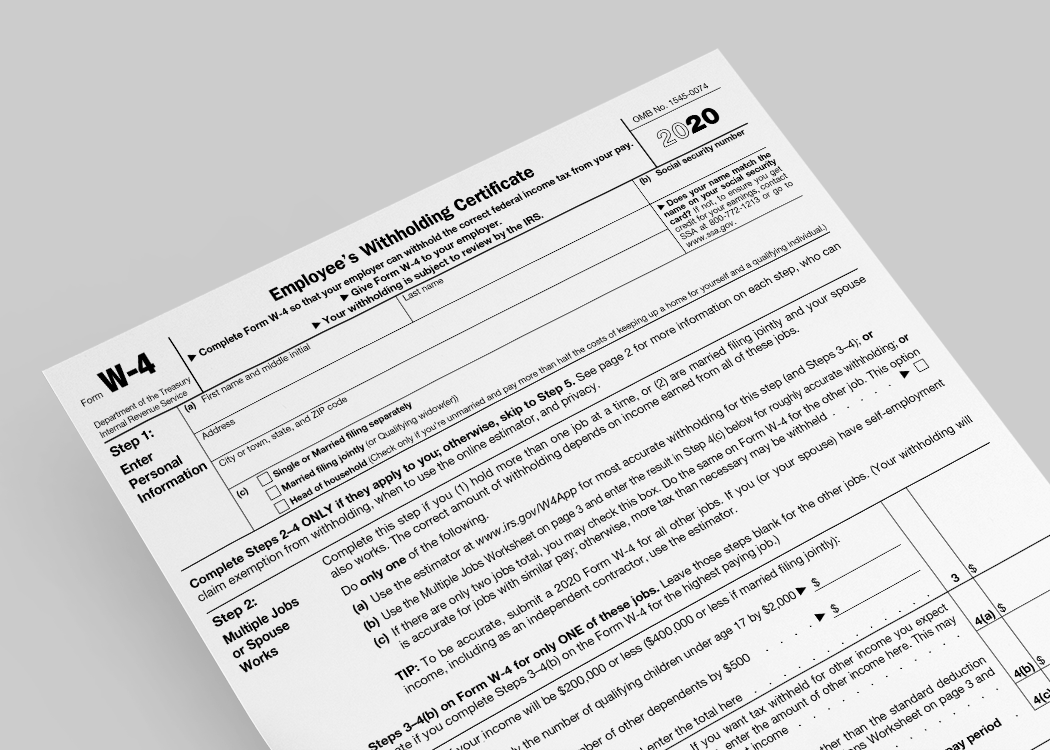

What You Need to Know About the Redesigned 2020 Form W-4

By now, you’ve probably heard the IRS has released a redesigned version of form W-4 for 2020, also known as the Employee’s Withholding Certificate....

Expert payroll management services with a personal touch.

View Solution Read Guide HR Support

HR SupportSimplify and personalize HR with a team of HR experts on-demand.

View Solution Read Guide Time & Attendance

Time & AttendanceWhy spend more unnecessary time and money managing your workforce?

View Solution Read Guide Hiring & Onboarding

Hiring & OnboardingTurn your candidates into employees with hiring & onboarding solutions.

View Solution Read GuideAdd On Solutions automate everyday tasks, prevent mistakes, and simplify business compliance.

View SolutionHelpful downloads and eBooks to empower your business.

Helpful tax and HR alerts to help keep your business compliant.

Payroll and tax-related forms and documents.

Log in to your employer (admin) and employee portals.

Horizon's blog provides valuable insight into payroll, compliance, human resources, and more.

See our client success stories for a case study on how we can help your business.

Payroll and HR strategy requires intelligent technology, personal attention and specialized expertise in the needs and nuances of your business.

We provide payroll and tax processing services for businesses from 1 to 1,000 employees or more. Today, we have nearly 1,000 customers in 40 states.

Welcoming a new employee comes with the necessary hurdle of onboarding paperwork. The I-9 form is often the launching point for documenting the arrival of your new team member. The form confirms the employee’s identity and eligibility for employment in the US regardless of their citizenship.

Welcoming a new employee comes with the necessary hurdle of onboarding paperwork. The I-9 form is often the launching point for documenting the arrival of your new team member. The form confirms the employee’s identity and eligibility for employment in the US regardless of their citizenship.

Completing the form is a joint effort; both the employee and employer are responsible for filling out portions of the I-9. The employer plays a key role in reviewing and confirming the employee’s eligibility status.

The I-9 form is not to be confused with E-Verify, a federal database program used to confirm a worker’s eligibility to work in the US. While E-Verify is not always required by state laws, the I-9 is necessary in all cases.

Since the 1986 Immigration Reform and Control Act, all paid workers have been required to complete an I-9, or the Employment Eligibility Verification Form. All workers, including those who are not US citizens, must fill out and file an I-9 form on their first official day of work.

The I-9 form must be completed in English in all states other than Puerto Rico, where Spanish is accepted as well. A translator must be provided to assist those that require help completing the form in English and complete the certification areas.

The I-9 contains three sections, both of which contain employee and employee responsibilities.

This section includes an area for the employee to include their name and other names used, such as their maiden name. The employee must write in their address, date of birth, citizenship status, and if applicable, their foreign ID number. Additional—and optional information depending on whether the employer uses E-Verify—includes the employee’s SS number, email address and phone number. Employees must sign and date the bottom of this section.

Employer Responsibilities for Section 1:

Employers must then review and sign Section 2 by the employee’s third business day of work. This area attests that the employer reviewed the employee’s identification materials outlined below. To do so, employees bring in one document from List A or a combination of identification from List B and C. All provided IDs must be original and up to date.

Note: Although employees are required to supply documentation, the employer must fill out this section on their own as they review the documents in person.

List A materials include:

List B items found here include:

Those under 18 or unable to provide the above items may include:

List C items include:

The majority of Section 2 is completed by the employer after their new worker has supplied proper documentation for examination.

Employer Responsibilities for Section 2:

The third section of the I-9 only needs attention if your employee’s forms of ID have expired or they have left your employment and were rehired within three years. You can also use this section if the employee had a legal name change.

The section includes an area for updated personal information such as name, date of rehire, updated documentation data, and the employer’s signature.

Employer Responsibilities for Section 3:

Employers must keep each employee’s updated I-9 form filed in a safe location for up to three years after they leave the company. These forms must be readily available for federal inspection if you are ever called upon to supply them. You do not need to mail I-9 forms to the USCIS office.

Employers may also store their copy electronically as long as they have proper system security. When storing the physical copy, keep each one in a separate location from more general employee documentation to secure their personal data.

The majority of I-9 complications derive from misreading or omitting information from the form. This may include failing to supply alternate names, checking the citizenship box, or leaving off translation information. The employer may also forget to thoroughly review their details such as singing appropriate sections or properly checking the details on provided employee ID.

Should you make an error on the form, the employer should cross out the error in a different color ink as well as date and initial the change.

The I-9 form should be one of your first tasks when onboarding a new employee. With proper attention to detail and recordkeeping, remaining compliant with USCIS will become an easy part of the process. Horizon Payroll Services can help you understand or streamline your onboarding experience, both by supplying federal tax forms and assisting in ongoing compliance.

4 min read

By now, you’ve probably heard the IRS has released a redesigned version of form W-4 for 2020, also known as the Employee’s Withholding Certificate....

5 min read

Summer is here and that means employees are making vacation plans. While your hourly employees, non-exempt from the Fair Labor Standards Act (FLSA),...

5 min read

You can earn a tax credit of up to $33,000 per employee in wages paid under the Employee Retention Credit (ERC) if your business was financially...