16 min read

Is Your HR Department Ready for 2024?

As 2024 arrives for businesses, human resource departments must evaluate if they are prepared for the changes ahead! The world of work moves fast,...

Expert payroll management services with a personal touch.

View Solution Read Guide HR Support

HR SupportSimplify and personalize HR with a team of HR experts on-demand.

View Solution Read Guide Time & Attendance

Time & AttendanceWhy spend more unnecessary time and money managing your workforce?

View Solution Read Guide Hiring & Onboarding

Hiring & OnboardingTurn your candidates into employees with hiring & onboarding solutions.

View Solution Read GuideAdd On Solutions automate everyday tasks, prevent mistakes, and simplify business compliance.

View SolutionHelpful downloads and eBooks to empower your business.

Helpful tax and HR alerts to help keep your business compliant.

Payroll and tax-related forms and documents.

Log in to your employer (admin) and employee portals.

Horizon's blog provides valuable insight into payroll, compliance, human resources, and more.

See our client success stories for a case study on how we can help your business.

Payroll and HR strategy requires intelligent technology, personal attention and specialized expertise in the needs and nuances of your business.

We provide payroll and tax processing services for businesses from 1 to 1,000 employees or more. Today, we have nearly 1,000 customers in 40 states.

3 min read

![]() Horizon Payroll Solutions

:

June 16, 2023 at 1:00 PM

Horizon Payroll Solutions

:

June 16, 2023 at 1:00 PM

In today’s ever-changing labor landscape, it’s hard to keep up with all of the new hire reporting requirements. If you’re wondering what’s required for new hire reporting in 2023, you’re not alone! Let’s break it down in this blog post – read on to learn more!

New hire reporting is a crucial step in the onboarding process for employers. It involves submitting necessary information about newly hired and rehired employees to the appropriate state agencies. This process helps state governments with child support enforcement and works to prevent fraud in public assistance programs. Understanding the requirements and importance of new hire reporting is essential for businesses to comply with the law and ensure smooth operations.

In this article, we will delve into the details of new hire reporting, the information required, how to report new hires, and how Horizon can assist businesses with this process.

New hire reporting is a legal requirement imposed by both federal and state governments in the United States. Its primary purpose is to enable state agencies to locate parents who owe child support and enforce child support orders effectively. By promptly reporting new hires, employers assist in establishing income withholding orders to ensure that employees make child support payments regularly and accurately. Additionally, new hire reporting helps prevent fraudulent claims in public assistance programs, such as unemployment benefits.

It is important to note that new hire reporting laws can vary from state to state. Employers must familiarize themselves with their jurisdictions' specific requirements and deadlines. Most states have designated online portals or forms where employers can submit new hire information electronically. Some states may require employers to submit monthly reports, while others may have different reporting intervals. Businesses must understand and adhere to their state's specific guidelines to avoid penalties and non-compliance.

When reporting a new hire, employers are typically required to provide specific information about the employee. The following are the common types of information required for new hire reporting.

Employers must provide accurate and complete information about the newly hired employee, including their full name, residential address, and Social Security Number (SSN). This information is crucial for state agencies to identify individuals and establish child support obligations accurately.

Some states may require additional details regarding paycheck allocation, such as the amount designated for child support or other court-ordered payments. This information helps ensure the correct amount is withheld from the employee's work wages to meet their financial obligations.

Employers must include the hire date and the employee's start date in the new hire report. This information helps determine the reporting period and establishes the employee's eligibility for certain benefits, such as health insurance.

Sometimes, the law may require employers to indicate whether the newly hired employee qualifies for health insurance coverage. This information is vital for determining the employee's eligibility and ensuring compliance with applicable healthcare regulations.

Along with employee information, businesses must provide their own details, such as the company's address, Employer Identification Number (EIN), and other identifying information. These pieces help state agencies match the reported employees with the appropriate employer and ensure accurate record-keeping.

Reporting new hires is typically done through online portals provided by state agencies. Each state agency differs, so it’s important to understand the regulations of the state in which you are reporting.

Most states offer an employer services portal allowing companies to submit new hire information electronically. These portals often require businesses to create an account and provide their EIN and other relevant information, as stated above in a new hire reporting form.

To comply with new hire reporting requirements, employers must familiarize themselves with their state's laws and deadlines. While federal law mandates reporting within 20 days of hire, individual states may have different reporting intervals. Failure to report new hires or meet reporting deadlines can result in penalties and fines.

Federal law requires employers to report new hires within 20 days of their hiring date. This deadline applies regardless of the state in which the business operates. Employers must understand and meet this federal requirement to avoid potential penalties and non-compliance issues.

Navigating the complexities of new hire reporting can be challenging for small businesses, especially when dealing with varying state requirements and deadlines. That's where Horizon comes in; we are proud to offer trusted solutions for HR, hiring, and onboarding processes, including comprehensive assistance with new hire reporting! Contact us today for more information.

Horizon understands the importance of compliance and efficiency in the onboarding process. Their innovative software and expert guidance can streamline new hire reporting, ensuring that businesses meet all legal requirements and deadlines. Horizon's solutions automate the reporting process, minimizing the risk of errors and providing companies with peace of mind throughout the onboarding of new employees.

If your business is seeking assistance with new hire reporting and wants to ensure compliance with state and federal regulations, reach out to Horizon today. Our team of experts can provide personalized guidance and support tailored to your specific needs! Whether you have questions about reporting requirements, need help navigating online portals, or want to streamline your entire onboarding process, Horizon has the expertise to help.

Contact our professional team today to learn more about our comprehensive services and how we can assist you in meeting your new hire reporting obligations efficiently and accurately.

16 min read

As 2024 arrives for businesses, human resource departments must evaluate if they are prepared for the changes ahead! The world of work moves fast,...

2 min read

The US Citizen and Immigration Services (USCIS), part of the Department of Homeland Security, released a revised I-9 Employee Eligibility...

4 min read

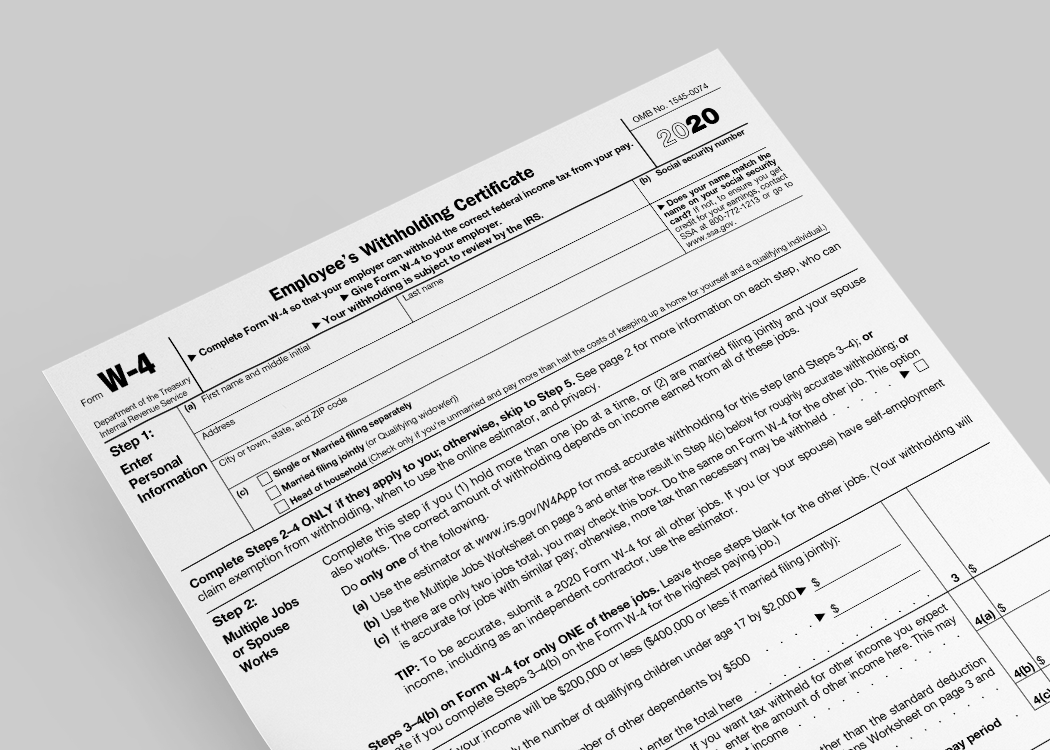

By now, you’ve probably heard the IRS has released a redesigned version of form W-4 for 2020, also known as the Employee’s Withholding Certificate....