3 min read

4 Major Benefits of a Paperless HR Solution

Talent acquisition is a time-consuming and costly process. According to Recruitorbox.com, below are the average amounts of time and money HR teams spend during the hiring process. HR Task Time (hours) Average Cost Job board posting...

READ BLOG +

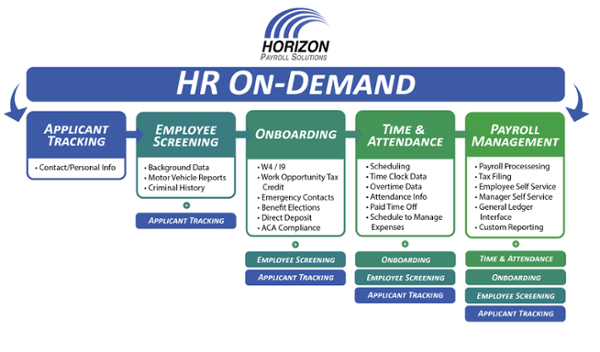

HR Support

HR Support Time & Attendance

Time & Attendance Hiring & Onboarding

Hiring & Onboarding