4 min read

What Is a PEO & Should Your Company Switch to One?

As your company grows, payroll, HR, and compliance tend to pile up on your desk. Suddenly you’re hearing terms like “PEO,” “co-employment,” and...

Expert payroll management services with a personal touch.

View Solution Read Guide HR Support

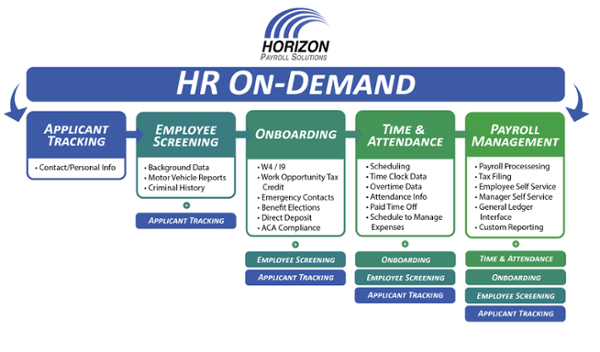

HR SupportSimplify and personalize HR with a team of HR experts on-demand.

View Solution Read Guide Time & Attendance

Time & AttendanceWhy spend more unnecessary time and money managing your workforce?

View Solution Read Guide Hiring & Onboarding

Hiring & OnboardingTurn your candidates into employees with hiring & onboarding solutions.

View Solution Read GuideAdd On Solutions automate everyday tasks, prevent mistakes, and simplify business compliance.

View SolutionHelpful downloads and eBooks to empower your business.

Helpful tax and HR alerts to help keep your business compliant.

Payroll and tax-related forms and documents.

Horizon's blog provides valuable insight into payroll, compliance, human resources, and more.

See our client success stories for a case study on how we can help your business.

Payroll and HR strategy requires intelligent technology, personal attention and specialized expertise in the needs and nuances of your business.

We provide payroll and tax processing services for businesses from 1 to 1,000 employees or more. Today, we have nearly 1,000 customers in 40 states.

4 min read

As your company grows, payroll, HR, and compliance tend to pile up on your desk. Suddenly you’re hearing terms like “PEO,” “co-employment,” and...

4 min read

In today's fast-paced business world, it's crucial to keep your organization running smoothly and efficiently. The human resources department is...

6 min read

Managing payroll records and employee files can be one of the more daunting and complicated aspects of running a business. From ensuring you have all...

5 min read

As of early 2023, economists observe that the labor market is incredibly tight. Hundreds of businesses and industries remain significantly...

3 min read

After working hard on completing your company’s end-of-year procedures, your human resources department may be ready to take a break. However, there...

1 min read

It’s the time of year for lists: shopping lists, gift wish lists, to-do lists, packing lists for travel, maybe even lists of lists … and at Horizon...

6 min read

Don't have time to read this article? Watch it instead! A common question that many business owners ask themselves is, "How frequently should I pay...

3 min read

Talent acquisition is a time-consuming and costly process. According to Recruitorbox.com, below are the average amounts of time and money HR teams...

5 min read

Disclaimer: This article is provided for informational purposes only and is not intended as legal advice. Please consult a legal professional or...

1 min read

This year started out like most, but now as it draws to a close so much is different. Even if January 1 can’t get here fast enough for you, those...

3 min read

The United States Bureau of Labor Statistics (U.S. BLS) reported a decline in unemployment rate by 2.2% via their “The Employment Situation - June...

3 min read

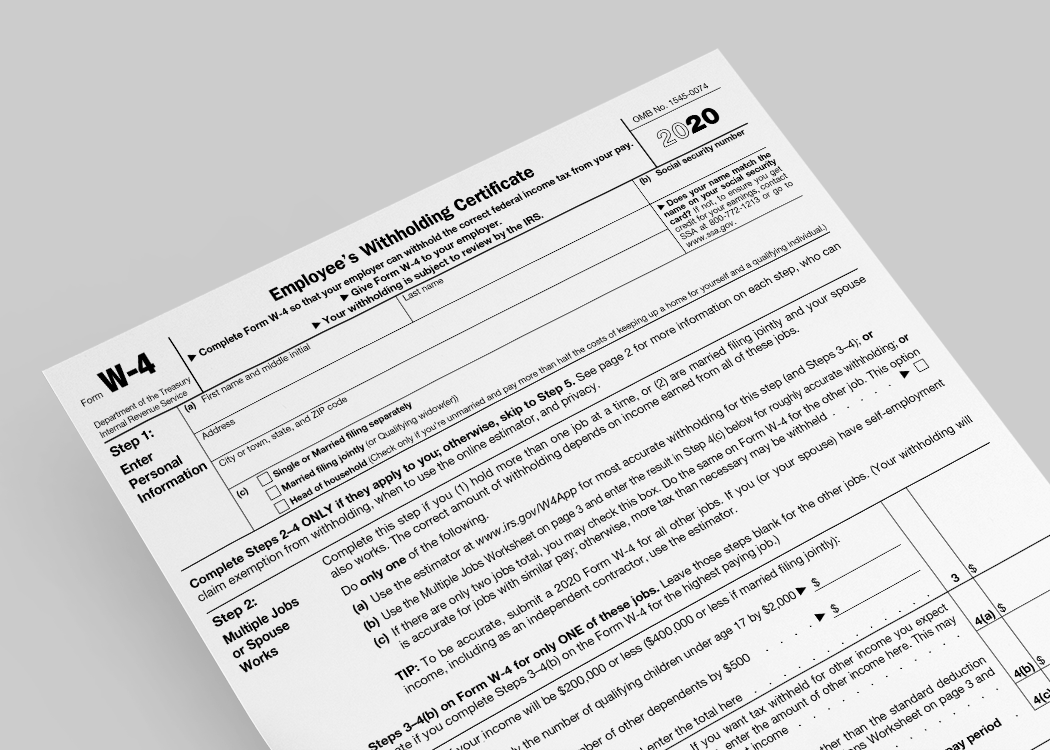

By now, you’ve probably heard the IRS has released a redesigned version of form W-4 for 2020, also known as the Employee’s Withholding Certificate....

4 min read

Supporting a strong team of employees can be just as challenging as finding a new candidate. Even top employees can steer off course and require...

3 min read

A Professional Employer Organization, or PEO, specializes in ubiquitous HR tasks like payroll, tax filings, benefits and retirement package...

3 min read

With unemployment at 3.9 percent in July 2018, it’s clearly a job candidate’s market. If you can find qualified candidates, they’re probably...

1 min read

By now most of us know the Millennial generation is the largest portion of the US workforce. And their numbers are only going to grow as Baby Boomers...

2 min read

As a millennial who has just graduated from college and been through the job search process, I’ve realized a few things about which company benefits...

3 min read

Congratulations! Your business has grown to 15 employees! Since your very first hires you’ve complied with labor laws like the Immigration Reform and...

4 min read

As you've probably heard, sexual harassment is making headlines. Men and women, from Hollywood stars to everyday people, are speaking out - and...

4 min read

Employee absences are inevitable. Scheduled or not, legitimate or not, absences mean less work completed as time and money go to paid sick time and...